Sustainable energy storage

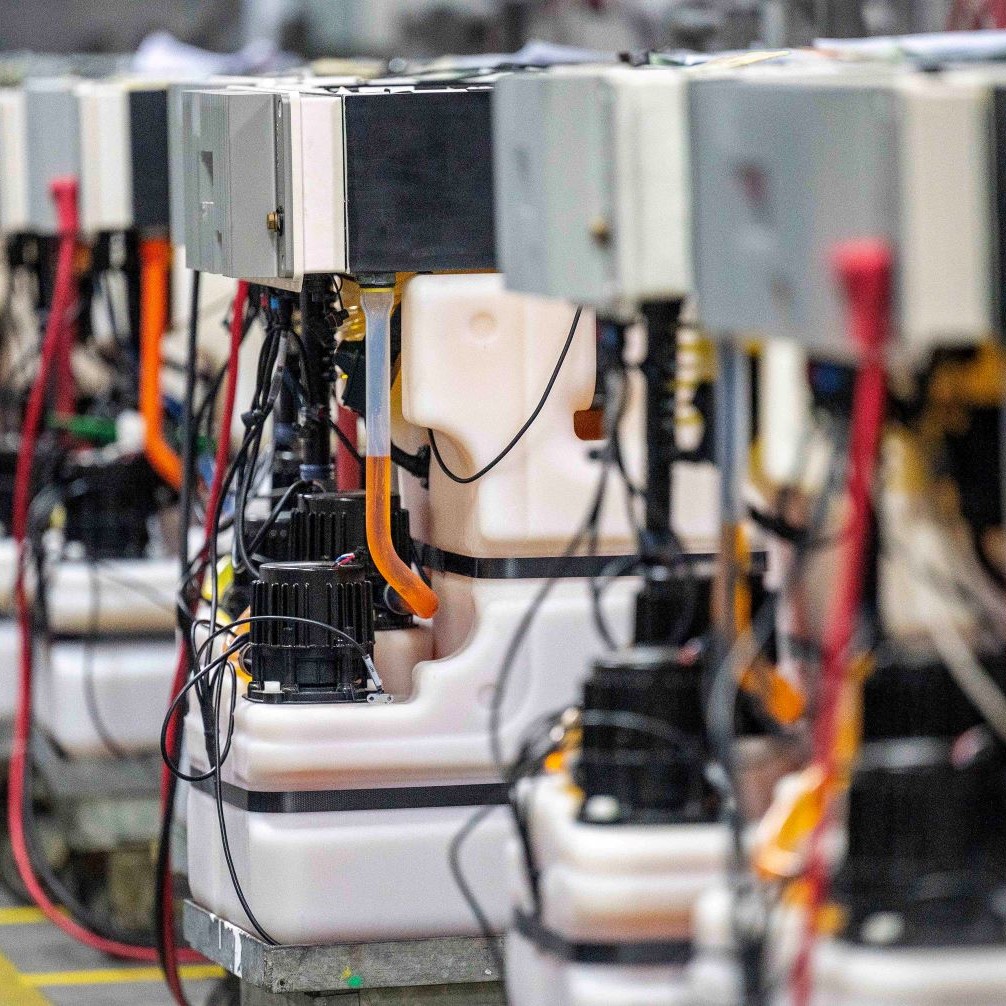

Redflow’s zinc bromine flow battery is one of the world’s safest, scalable and most sustainable energy storage solutions in the market.

The battery offers a long-life design and chemistry that makes use of cost-effective, abundant, fire-safe, and low toxicity materials. Redflow’s batteries are ideal for extended duration applications in a wide range of commercial installations and multi-megawatt hour storage deployments.

Global delivery

With deployments around the world, Redflow can meet your storage needs wherever you are.

International energy storage

In 2021 Redflow delivered its largest project to date, a 2MWh energy storage system in California, USA.

Recent news

Redflow awarded second US Department of Defense contract

23 APRIL 2024

Redflow allocated QLD government grant funding for feasibility study

29 FEBRUARY 2024

Redflow receives notice to proceed for microgrid project in US

12 FEBRUARY 2024

Redflow identified as preferred battery for a 6.6 MWh project

06 FEBRUARY 2024

"If you look past lithium ion, probably zinc is the next metal that’s the most popular for energy storage, and it does appear to be able to provide performance equal to or better than lithium…"

Mike Gravely, California Energy Commission Forbes

"California Sees Zinc as Likely Successor to Lithium Ion in Energy Storage", 6 October 2020

+ 61 7 3376 0008

[email protected]

Hey there, this is the default text for a new paragraph. Feel free to edit this paragraph by clicking on the yellow edit icon. After you are done just click on the yellow checkmark button on the top right. Have Fun!